center for responsible lending payday loans

If we approve your application the funds will be disbursed from our account in Utah. 29 months for unsecured loans.

Center For Responsible Lending

Student loan debt has topped 15 trillion in recent years making it the largest type of consumer debt outstanding other than mortgages.

. If an alternative is available please check if it is more affordable before borrowing payday loans. The average student loan borrower graduates with nearly 30000 in debt. Shopping for a home to pay bills to pay off or consolidate debt to establish credit to buy or.

Find in-depth news and hands-on reviews of the latest video games video consoles and accessories. Interest rates at 3 for 30-year fixed loans were at multi-decade highs. Microfinance is a category of financial services targeting individuals and small businesses who lack access to conventional banking and related services.

Read the opinion. The Plaintiffs contend. Online lenders Loan amounts at online lenders start around 1000 or 2000.

The court summarized its ruling this way. Exhibitionist Voyeur 060617. Microfinance services are designed to reach.

The Financial Conduct Authority FCA estimates that there are more than 50000 credit firms that come under its widened remit of which 200 are payday lenders. Community Financial Services Association of America and Consumer Service Alliance of Texas challenge the validity of the Consumer Financial Protection Bureaus 2017 Payday Lending Rule. In most cases loan decisions may take up to 30 minutes during office working hours.

MaxLend offers installment loans as an alternative payday solution providing emergency funding for up to 3000 as soon as today. Mortgage rates are just shy of 7. The Community Reinvestment Act CRA PL.

That the Bureau is. Exhibitionist Voyeur 060817. Applicant verification and traditional credit checks via various national databases by Cashfloat responsible lending policy.

Find out what other users have to say about its key features. 1147 title VIII of the Housing and Community Development Act of 1977 12 USC. The 14 billion Chicago-based credit union founded in 1935 is one of the.

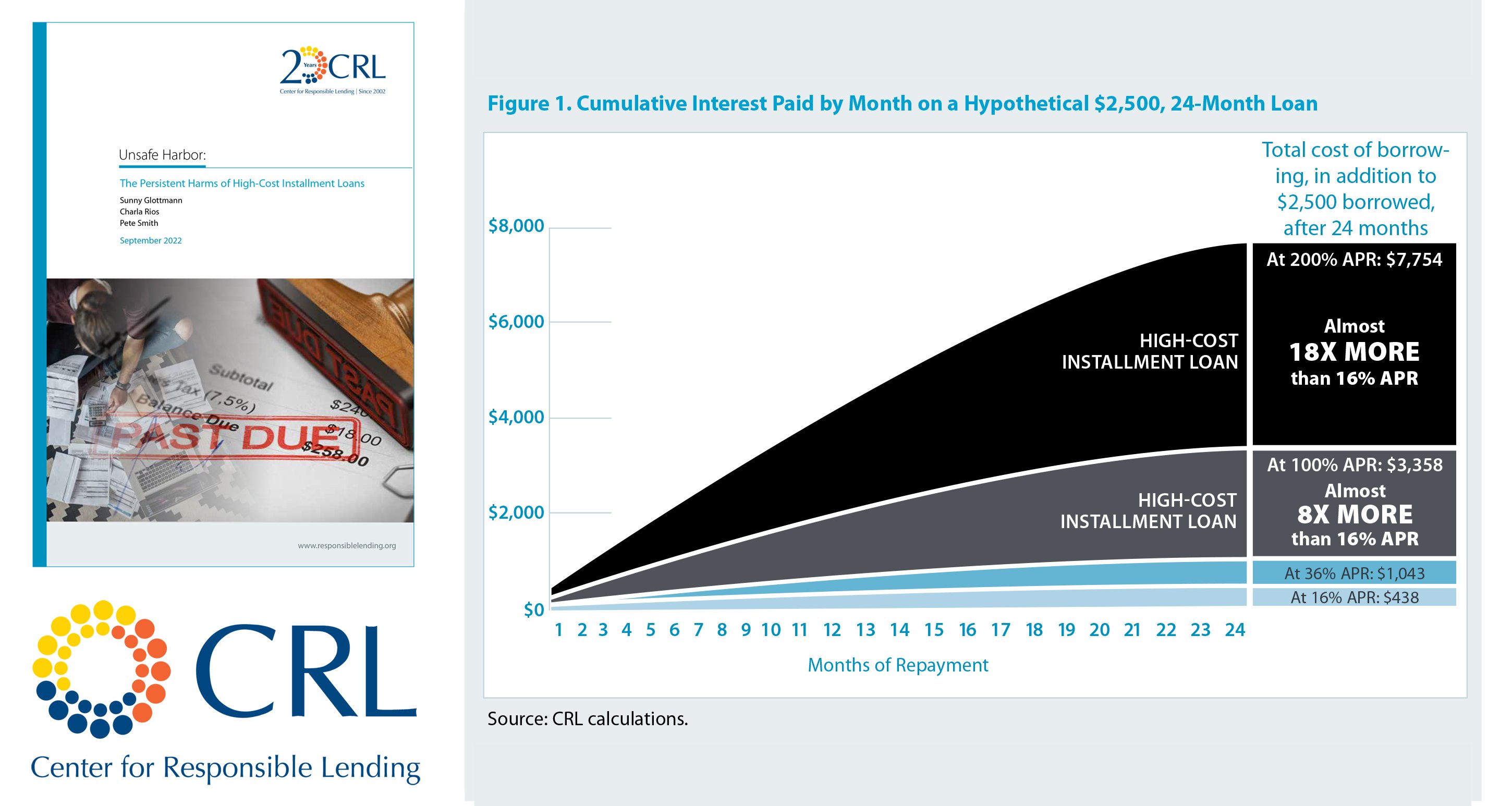

232 prohibits lenders from charging service members more than 36 APR on credit extended to covered borrowers. 43 for secured loans. The center states that the devotion of 2550 percent of the borrowers paychecks leaves most borrowers with inadequate funds compelling them to take new payday loans.

They are the cousin of unsecured loans such as payday loansSince borrowers use their car titles to secure the loans theres risk. Foot Locker 477 Caleb has Molly hit the showers. Oil Slick 477 Molly greets her webcam Followers.

The situation has become so. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Center for Responsible Lending.

To help consumers put these recent changes into perspective the Center for Responsible Lending analyzed the average APR for a 300 loan in each state based on a 14-day loan term. Title loans first emerged in the early 1990s and opened a new market to individuals with poor credit and have grown increasingly popular according to studies by the Center for Responsible Lending and Consumer Federation of America. And payment systems among other services.

Farahi of the Center for Responsible Lending said its study found 3 in 4 survey participants took out short-term installment loans in excess of 1000. Speedy Cash Payday Loans is MOSTLY NOT RECOMMENDED based on 62 reviews. Federal credit unions charge maximum APRs of 18 for personal loans and 28 for payday alternative loans.

According to the Center for Responsible Lending 76 of the total volume of payday loans are due to loan churning where loans are taken out within two weeks of a previous loan. Today home prices in many metros have started to fall. The Consumer Financial Protection Bureau says that 94 of repeat payday loans churning happen within one month of the first loan and that consumers using payday loans borrow an average of 10 times a year.

Applicant is responsible for complying with all statutory obligations regarding obtaining loans by internet that may exist in their state of residence. Savings and checking accounts. The interest and fees amount to 21 billion for borrowers.

OLA members adhere to the OLA Responsible Lending Policy. Heather challenges Molly to be the center of attention. And interest rates ranged from 100 to 189.

Average loan term. If you need money fast Alliant Credit Union typically makes same-day online personal loans between 1000 and 50000. Of approximately 6 million PPP loans reviewed by the National Bureau of Economic Research Black-owned businesses accounted for 86 of all loans issued with 265 issued by fintech lenders and.

Retrieved September 21 2012 from. Building on the achievements of progressive pioneers such as Teddy. Microfinance includes microcredit the provision of small loans to poor clients.

Utah law governing consumer loan agreements may differ from the laws of the state where you reside. Payday loans are expensive. Exhibitionist Voyeur 060717.

2901 et seq is a United States federal law designed to encourage commercial banks and savings associations to help meet the needs of borrowers in all segments of their communities including low- and moderate-income. The Center for American Progress is dedicated to improving the lives of Americans through progressive ideas and action. One predictor of borrower distress is whether the student attended.

With us you can get easy and instant approval installment loans which are available even for bad credit borrowers. Active duty service members and their covered dependents. The CFPB estimates that over 1-in-4 borrowers are delinquent or have defaulted on their student loan debt.

The Military Lending Act 32 CFR. The loan is secured on the borrowers property through a process. Our quick installment loans come with a guaranteed and virtually instant approval so you enjoy all the benefits of payday loans while also benefitting from the flexibility and comfort that comes along with a monthly installment loan.

Payday loans in the United Kingdom are a rapidly growing industry with four times as many people using such loans in 2009 compared to 2006 in 2009 12 million people took out 41 million loans with total lending.

Center For Responsible Lending Crlonline Twitter

Center For Responsible Lending Crlonline Twitter

High Interest Payday Loan Lenders Target Vulnerable Communities During Covid 19 Here Now

Payday Other Small Dollar Loans Center For Responsible Lending

Federal Court Rejects Mulvaney And Payday Lenders Scheme To Delay Cfpb Payday Rule Implementation Paymentsjournal

Let My People Go Cap The Rate 36

Commentary Yes Nevada There Are Alternatives To Payday Loans Nevada Current

Payday Lending Traps Louisianans In Triple Digit Interest Debt Louisiana Budget Project

Diane Standaert On Potential Changes To Payday Lending Rules C Span Org

The State Of Lending Bank Payday Loans Center For Responsible Lending

New Federal Rule Strikes A Blow Against Payday Loans

As Ky Payday Lenders See Business Dropping Industry Seeks Forgivable Loans Kentucky Center For Investigative Reportingkentucky Center For Investigative Reporting

Industry Watchers Predict Surge In Payday Lending Nevada Current

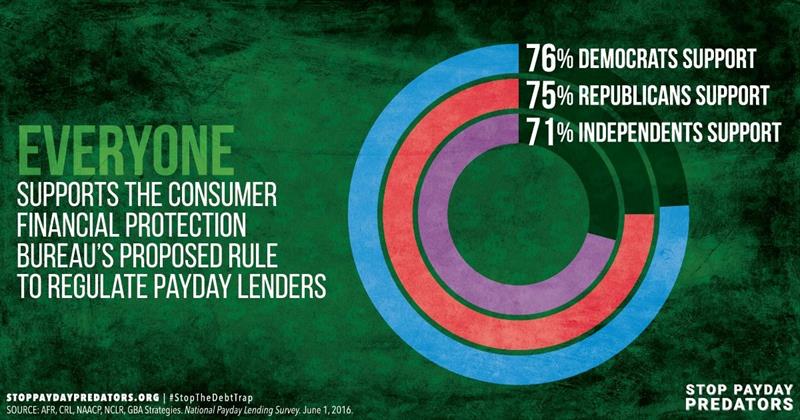

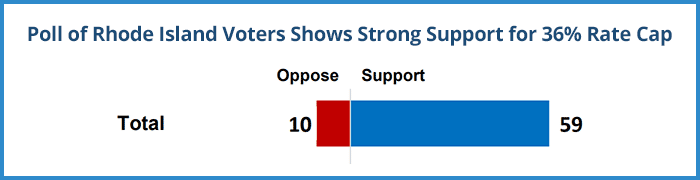

New Polling Shows Support For R I Payday Lending Reform

Center For Responsible Lending Crlonline Twitter

The Sky Doesn T Fall Life After Payday Lending In South Dakota Center For Responsible Lending

Poll Finds Broad Bipartisan Support For Lowering Payday Loan Interest Rates From 260 To 36 In Rhode Island Center For Responsible Lending

Center For Responsible Lending Archives Oklahoma Policy Institute