straight life policy cash value

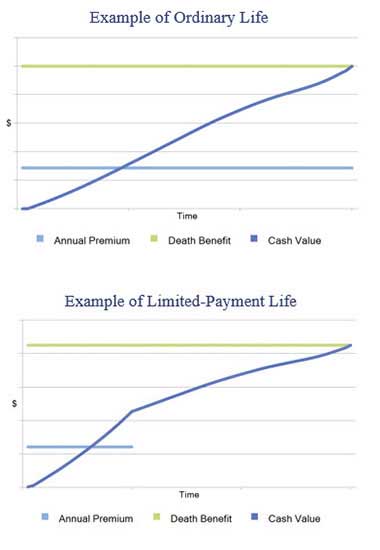

Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments. In most cases the premium and death benefit stay constant for the.

Componential Analysis Whole Of Life Insurance Whole Of Life Insurance Whole Life Insurance Offers The Policyholder A Cash Value Account And Tax Deferred Ppt Download

Variable life insurance is a type of permanent life insurance with a cash value and with investment options that work like a mutual fund.

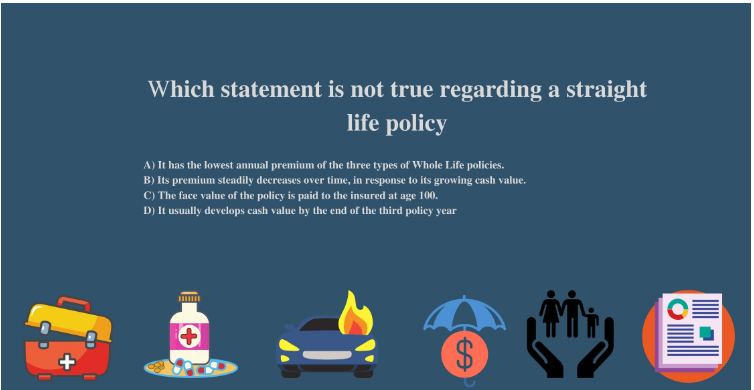

. The cash value is. A straight life insurance policy often known as whole life insurance has a cash value account. Straight whole life insurance can be accurately described in all of these statements EXCEPT 1.

Universal life insurance is a type of. Also known as whole life insurance a straight life policy has a. Also known as whole life insurance a straight life policy has a.

In return you receive a death benefit that is. Its purpose is to help offset the increasing cost of insurance as you age but you. A life insurance policys cash value is distinct from the death benefit.

Cash value is a feature of permanent life insurance policies including whole life insurance. One of the advantages of cash value life insurance is that any earnings in the cash value do not incur a current tax liability. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the.

The cash value grows slowly tax-deferred meaning you wont pay taxes on its gains while theyre accumulating. Policy protection normally expires at age 65 2. In general any earnings in the cash value are allowed to grow on a.

Face net premium cash face A 5-year term life policy will cost ____ a 1-year. Straight life insurance is a policy that provides lifelong life insurance coverage with continuous level premium payments. Call 847 403-8569.

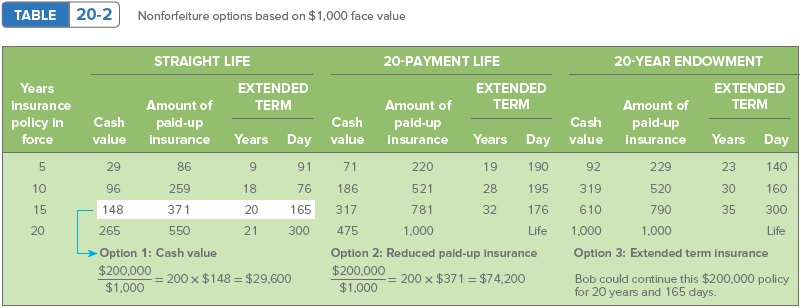

A portion of the premium you pay for a straight life policy is added to the account each month. Its been used for centuries to grow and protect policyholders moneyand not just by the wealthy. Nonforfeiture values are available to the.

A straight life insurance policy provides lifelong coverage at a consistent premium rate. A term life insurance policy will pay out the ____ value if the insured dies during the term of the contract. Single premium life insurance SPL is a type of policy that can be fully funded in a single payment.

A straight life insurance policy is one of the oldest types of insurance. A straight life insurance policy can also build cash value over time.

Term Vs Whole Life Insurance Differences Pros Cons Nerdwallet

Is A Straight Life Insurance Policy Right For You Wealth Nation

Whole Life Insurance State Farm

What Is A Straight Life Policy Bankrate

10 Financial Planning With Life Insurance Ppt Video Online Download

Cash Value Life Insurance What You Need To Know The Insurance Pro Blog

Synonyms For Whole Life Insurance Thesaurus Net

Life Insurance Purposes And Basic Policies Mu Extension

Solved Calculate The Cash Surrender Value For Lee Chin Age 42 Who Course Hero

Which Statement Is Not True Regarding A Straight Life Gudwriter

:max_bytes(150000):strip_icc()/best-whole-life-insurance-4845955_final-c60b6733837046e5a5213deb9e87ccd5.png)

Best Whole Life Insurance Companies Of November 2022

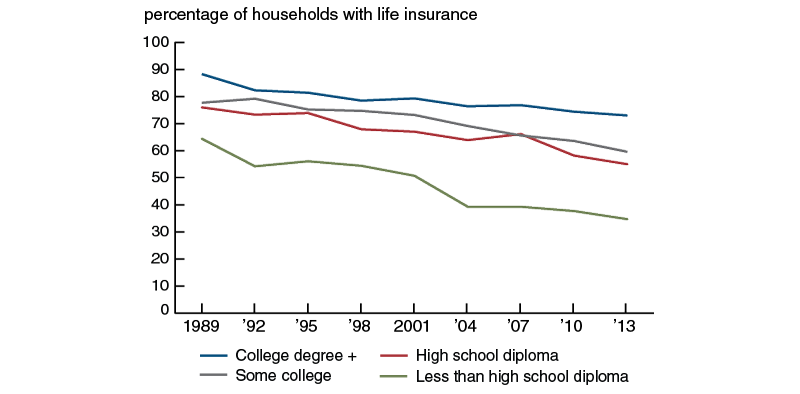

What Explains The Decline In Life Insurance Ownership Federal Reserve Bank Of Chicago

Answered J C Monahan Age 40 Bought A Bartleby

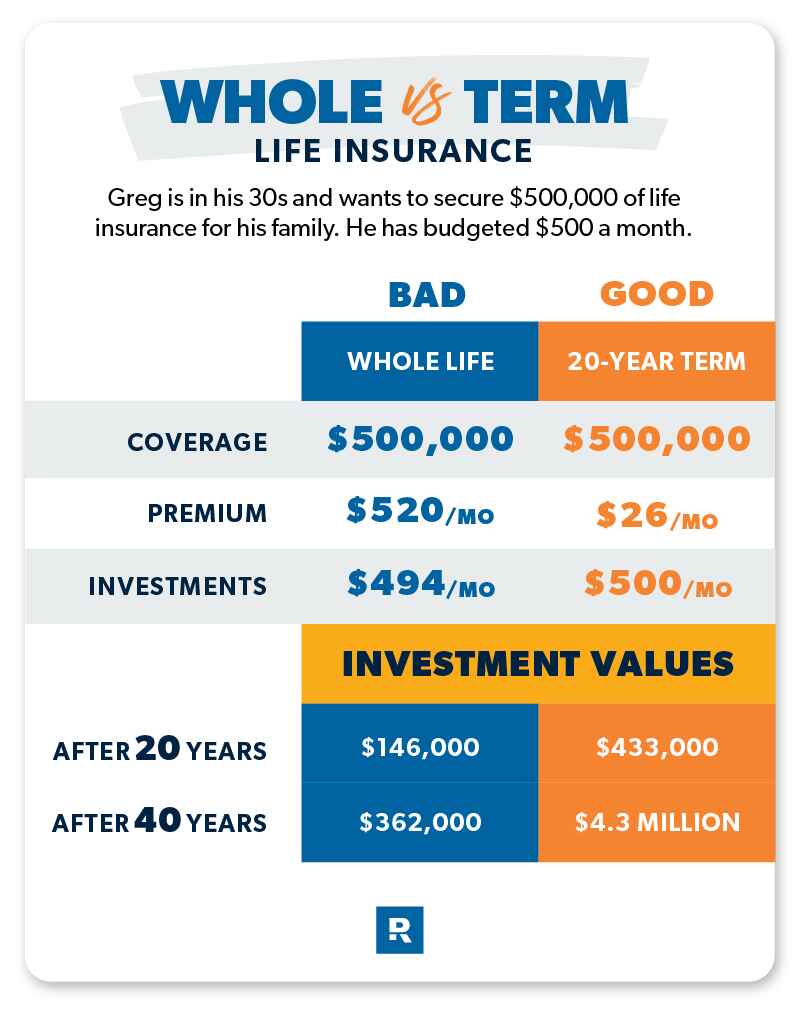

Term Vs Whole Life Insurance What S The Difference Ramsey

The 7 Types Of Life Insurance Policies What S The Best One For You

What Is A Straight Life Policy Bankrate

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

:max_bytes(150000):strip_icc()/dotdash-term-life-vs-whole-life-5075430-Final-60fb4e8f7bae43e0a65a3fac2431479c.jpg)